This can be a second put up from a set of feedback I gave on the NBER Asset Pricing convention in early November at Stanford. Convention agenda right here. My full slides right here. First put up right here, on new-Keynesian fashions

I commented on “Downward Nominal Rigidities and Bond Premia” by François Gourio and Phuong Ngo. The paper was about bond premiums. Commenting made me understand that I believed I understood the difficulty, and now I understand I do not in any respect. Understanding time period premiums nonetheless appears a fruitful space of analysis in any case these years.

I believed I understood threat premiums

The time period premium query is, do you earn extra money on common holding long run bonds or short-term bonds? Associated, is the yield curve on common upward or downward sloping? Ought to an investor maintain lengthy or brief time period bonds?

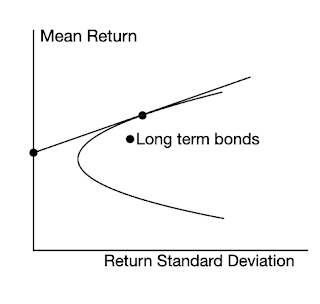

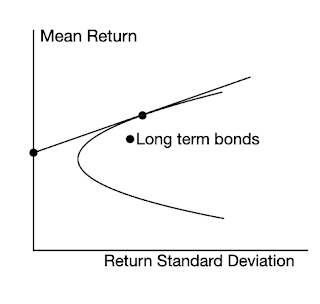

1. To start with there was the imply variance frontier and the CAPM.

(They are not, or not simply primarily based on this commentary. Bonds are round 40% of the market. Good last examination query: Given the above image, ought to a mean-variance investor get out of bonds? Is the market value and amount irrational? Trace: Particular person shares are additionally contained in the frontier.)

Extra exactly, short-term bonds or the “threat free fee” are the perfect funding for risk-averse buyers. Long run bonds are at finest a part of the dangerous portfolio. Much less threat averse buyers maintain a few of them for barely higher return and diversification.

That results in the usual presupposition that long-term bonds have increased returns, and the yield curve slopes up, to compensate for his or her additional threat. That is not fairly proper — common return depends upon betas. Long run bonds have increased returns, if their additional threat covaries with inventory threat. They may very well be “destructive beta” securities, however that’s unlikely. Larger rates of interest decrease inventory costs too.

Now, your presupposition is that long run bonds ought to have the bottom yields, being most secure, and short-term bonds ought to have the next imply return to compensate for additional threat.

However we’re speaking about nominal bonds, not listed bonds. The danger-free proposition holds if actual rates of interest range, however inflation doesn’t.In that case, brief bonds have roll-over threat for long run buyers, and lengthy bonds have regular payouts. If inflation varies however actual charges are fixed, then short-term bonds have much less threat for long run buyers.

That means an attention-grabbing view: Till 1980, inflation was fairly variable, and we must always see upward sloping time period construction and threat premium. After 1980, or at the least after 1990, inflation was secure and actual rates of interest diversified. The danger premium ought to flip round.

They did. In all of the arguments about “financial savings glut,” “low r*” and so forth, I by no means see this fundamental mechanism talked about. Bonds are nice negative-beta securities to carry in a recession or monetary disaster.

And, that holds particularly for presidency bonds. Have a look at 2008, and keep in mind that costs transfer inversely to yields. Holding 10 12 months authorities bonds would have been a lot better than holding BAA bonds! That saving grace in a extreme monetary disaster, when the marginal utility of money was excessive, may effectively account for a number of the in any other case a lot increased yield of BAA bonds.

However at this time we’re wanting on the time period premium, lengthy bonds vs brief bonds, not the general worth of bonds. Now, brief bond yields go down much more than long run yields. However value is 1/(1+y)^10, and the brief bonds mature and roll over. It isn’t apparent from the graph which of lengthy or brief bonds has a greater return after inflation going by the monetary disaster. However that’s straightforward sufficient to settle.

However I did not

Studying Gourio and Ngo made me understand this cozy view was a bit lazy. I used to be taking a look at covariance of return with one-period marginal utility, forgetting the entire long-horizon investor enterprise that introduced me right here within the first place. The primary lesson of Campbell and Vieira’s work is that it’s nuts to do one-period imply and alpha vs beta evaluation of bond returns. Extra exactly, in the event you do that you just should embody “state variables for funding alternatives.” When bond costs go down bond yields go up. You’ll make all of it again. That issues.

But right here I used to be fascinated with one-period bond returns and the way they covary with instantaneous marginal utility. What issues for the long-horizon investor is how a nasty final result covaries with remaining lifetime consumption, remaining lifetime utility. Returns that fall in a recession should not matter a lot in any respect if we all know the recession will finish.

There may be, in fact, one particular case wherein consumption at this time is a ample statistic for lifetime utility — the time-separable energy utility case. To make use of that, although, you actually have to take a look at nondurable consumption, not different measures of stress. And, in fact, I am assuming that long-term buyers drive the market.

Usually we don’t impose the consumption-based mannequin. So it stays true, if you’re fascinated with anticipated returns when it comes to betas on numerous elements, it’s completely nuts not to consider long run bonds with elements resembling yields which might be state variables for future funding alternatives.

Gouio and Ngo use a consumption-based mannequin, however with Epstein Zin utility. (Grumble grumble, habits are higher for capturing time-varying threat premeia.) The facility utility proposition that at this time’s consumption is a ample statistic for details about the longer term additionally falls aside with Epstein Zin utility. A whole lot of the purpose of Epstein Zin primarily based asset pricing is that anticipated returns line up with consumption betas, however additionally and infrequently predominantly with betas on info variables that point out future consumption.

Right here, my remark isn’t important, however simply interpretive. If we need to perceive how their or any mannequin of the bond threat premium works, we can’t assume as I did above merely when it comes to returns and present consumption. We’ve got to assume when it comes to returns and knowledge variables about future consumption, a set of state-variable betas. Or, following again to Campbell and Viceira’s stunning perception, we must always take into consideration returns as will increase in the entire stream of consumption. We must always take into consideration portfolio concept when it comes to streams of payoffs and streams of consumption, not one-period correlations and state variables.

What is the reply? Why do Gourio and Ngo discover a shifting time period premium? Effectively, I lastly know the query, however probably not the instinct of the reply.

You possibly can see how my try to seek out instinct for bond premiums follows advances in concept, from mean-variance portfolios and CAPM, to ICAPM with time-varying funding alternatives, which bonds have in spades, to a long-term payoff view of asset pricing, to time-varying multi issue fashions, to the results of Epstein Zin utility.

However up to date finance is now exploring a wild new west: “institutional finance” wherein leveraged intermediaries are the essential brokers and the remainder of us fairly passive; segmented markets, secure asset “shortages” “noise merchants” and pure provide and demand curves for particular person securities, neither related throughout property by acquainted portfolio maximization nor related over time by commonplace market effectivity arguments. With this mannequin of markets in thoughts, clearly, who ought to (or can!) purchase long run bonds, and the way we perceive time period premiums, might be vastly completely different.

So, I am going from a really settled view with just a bit clarification wanted — lengthy vs brief time period bond recession betas — to seeing that the essential story of time period premiums actually continues to be on the market ready to be discovered.

[ad_2]